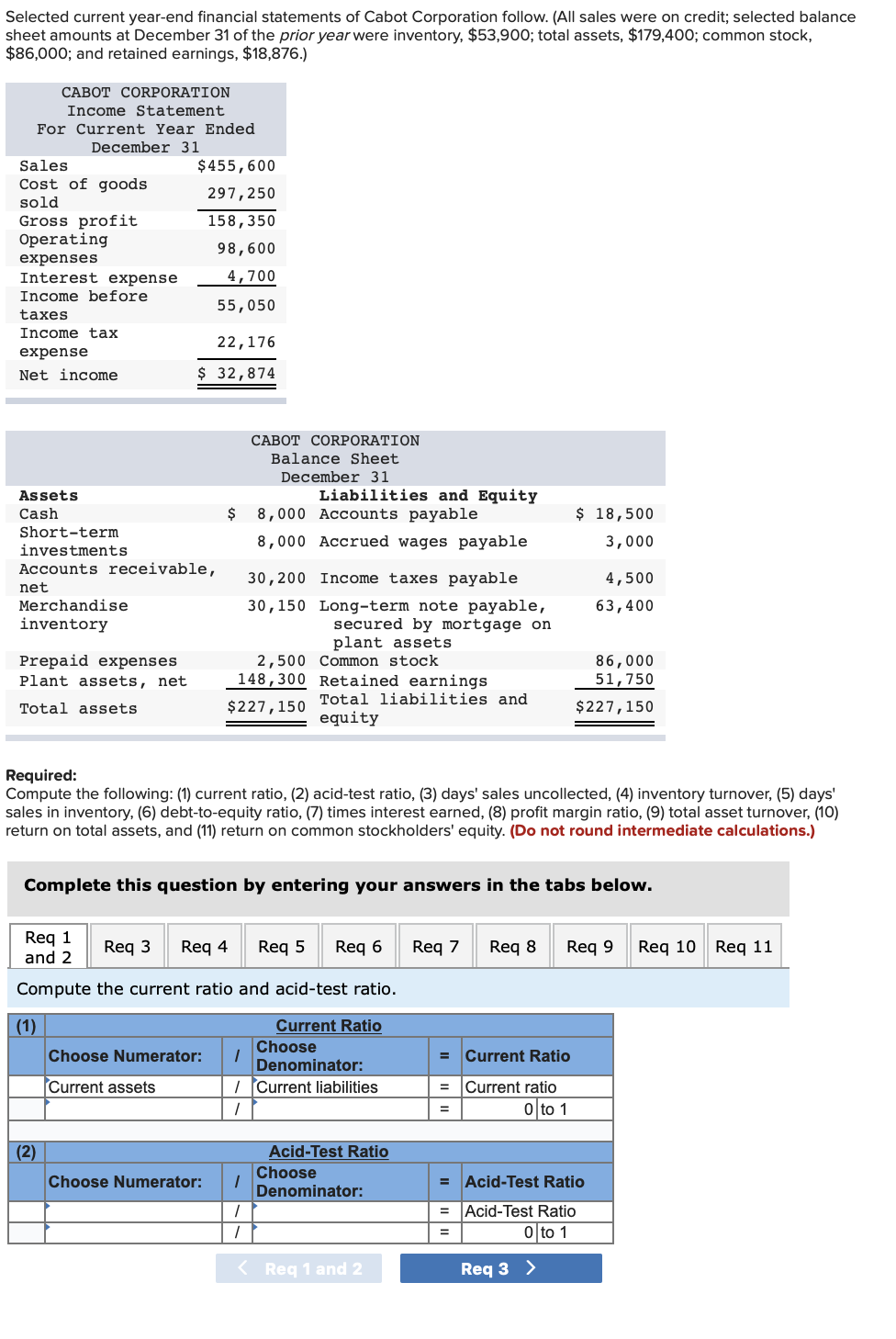

Sales on a balance sheet represent the total amount of revenue generated from selling goods or services. To calculate net credit sales, subtract any returns, allowances, or discounts from the total sales figure. This gives a more accurate representation of the company’s actual revenue from credit transactions. Credit sales would also impact days sales outstanding and accounts receivable.

Understanding Net Sales

- Total revenue minus cost of sales returns, allowances, and discounts equals net sales.

- Furthermore, credit sales refer to sales that are made on credit, where customers are allowed to pay at a later date.

- However, while credit sales can be beneficial in attracting customers and driving sales, they also come with certain risks.

- In a vacuum, a higher ratio is a sign of speedy payment for creditor services.

- It provides insights into the company’s ability to generate sales volume and evaluate the effectiveness of its credit policies.

- When this happens, those sales are essentially lost, and they chip away at your gross credit sales.

Don’t mistake this for the bottom line, which is the net performance result an organization publishes at the end of a given period – say, a month or fiscal quarter. While net credit sales is not directly reported on the statement of cash flows, it does have an impact on the cash flow from operations section, which is a significant component of this statement. Credit sales occur when a business allows its customers to purchase goods or services on credit, meaning they do not have to make an immediate payment. Instead, the customer is given a certain period of time, usually 30 days or more, to settle the payment.

Credit Sales Ratios

Net credit sales influence the accounts receivable balance, which is listed as a current asset on the balance sheet. Accounts receivable represents the amount owed to the company by its customers for credit sales. An increase in net credit sales will result in a higher accounts receivable balance, as more customers will owe money to the company for their purchases. The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It presents a summary of the company’s assets, liabilities, and shareholders’ equity.

Cash Flow Statement

Net profit is the net benefit which is the business’s income minus the working costs and cost of merchandise sold. In addition to this, businesses also use gross margin to understand the relationship between their productions costs and revenues. Gross margin is the amount of profit that remains before deducting selling, general, and administrative, and interest expenses.

Net Credit Sales on Financial Statements & Ratios

In the next section, we will discuss how net credit sales can be analyzed to gain valuable insights into a company’s financial performance and credit management. If a company consistently generates positive net credit sales, it contributes to an increase in net income and, subsequently, an increase in retained earnings on the balance sheet. This indicates a profitable operation and enhances the financial health of the company. Accounts receivable is an important asset for a company, but it also carries some risks. There is always a chance that customers may default on their payments, resulting in uncollectible accounts receivable, also known as bad debt. And your account journal is proof that your business operations are going all okay and smooth.

You can quickly pick out a specific section of that data, such as annual credit sales, if you know where to find it within the statements. Next, we will explore how net credit sales impact the statement of cash flows, providing information about the company’s cash inflows and outflows. where to find net credit sales on financial statements Next, we will explore where net credit sales can be found on financial statements and how it influences other aspects of a company’s financial reporting. This means the revenue you expect to collect from credit sales, after adjusting for returns, allowances, and discounts, is $43,700.

Understanding the relationship between net credit sales and financial statements provides valuable information for planning, forecasting, and decision-making. It helps stakeholders evaluate a company’s financial performance, assess liquidity and cash flow, and identify opportunities and risks within the market. Net credit sales are an indicator of a company’s ability to generate revenue from credit sales transactions. Monitoring net credit sales allows businesses to assess their sales growth, evaluate credit management practices, and make informed decisions regarding credit policies and pricing strategies. This accounting item is used to calculate various other financial analysis items like days sales outstanding and accounts receivable turnover ratio.

In a vacuum, a higher ratio is a sign of speedy payment for creditor services. For companies with a high percentage of credit sales, the average collection period may give a better indication of how successfully the company is converting its credit sales to cash. Effectively run businesses generally aim for an average collection period of about a third less than the maximum credit terms.

Set your business up for success with our free small business tax calculator. Save more by mixing and matching the bookkeeping, tax, and consultation services you need.

A potential problem with this calculation is that some of the sales returns and allowances may be related to sales that were originally paid in cash (not with a credit sale). If so, you will need to back out these returns and allowances from the calculation. Net credit sales also play a starring role in the accounts receivable turnover ratio, which tells you how efficiently your company collects debt. Simply put, Net credit sales are all the sales a company makes on credit, minus a few deductions. We’re cleaning up the gross credit sales (the total sales made on credit) to get a clearer picture of the actual revenue. By analyzing both gross credit sales and net credit sales, businesses can gain insights into their sales strategies, customer behavior, and overall financial health.

By analyzing days sales outstanding and accounts receivable, a company can assess the efficiency of its receivables account and credit policies. This information is crucial for managing cash flow and assessing financial health. Also, understanding the relationship between profit and loss statement and net credit sales would provide insights into the company’s financial performance.